Disruption To Growth: Navigating The Sensor Revolution

By Pallavi Madakasira, analyst, Lux Research

As critical gateways to the Internet of things (IoT), sensors are sure to have a massive social and economic impact globally within the next decade. The notion of everything, from smart cities to smart vehicles to smart factories, is expected to accelerate the development and use of different types of sensors. The prospects for growth in the sensors industry has fueled the appetite for developers to innovate across all applications, in an effort to sell sensors with attributes such as high resolution and low power consumption to end users. Users on the other hand are much more focused on growing their top-line or reducing their cost line item over time.

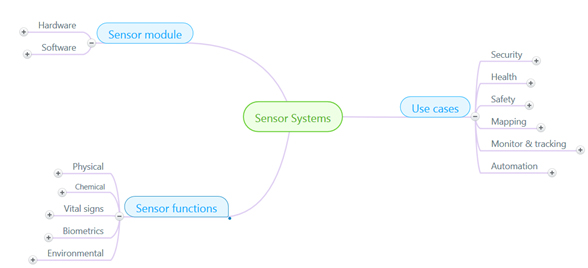

- The How, What and Why of sensors: Lux Research’s sensor taxonomy framework provides a framework to navigate through this confusing sensors landscape. While the sensor module defines the “How”, sensor “functions” is a catch-all for the “What,” and the use-cases define the “Why.” The use-cases, for example, can help find technology adjacencies to leverage an existing sensor solution in a different application. For instance, hyperspectral cameras are in demand in agricultural applications although they can also be used in Oil & Gas sectors to detect hydrocarbon seepage and vegetation stress.

- Developers should focus on high-growth use-cases or on addressing new use-cases: High-growth markets such as diabetes monitoring, biometric authentication, and automotive sensors will offer lucrative business for fast movers that can develop efficient and cheap solutions. For example, recent scandals and increasing regulations in the automotive industry for fuel efficiency will actually mean increased demand for pressure sensors (that are today used widely in a car to check for fuel line pressures) but also innovations that specifically address tire pressure monitoring systems, as OEMs and sensor developers alike look to meet tighter regulations. Finding new applications, on the other hand, with similar use-cases will ensure developers can leverage already proven sensor solutions to generate an additional revenue stream. For instance, sensors that can detect corrosion in pipes can be used in both the oil & gas industry, where detection corrosion in hard-to-reach pipes can prevent catastrophic failures, and in the water industry, where the direct cost of metallic corrosion is estimated to be $276 billion on an annual basis in the United States alone.

- Users should acquire/invest/partner: Since there are sensors for every conceivable use-case, end users have to grapple with the value that sensors will enable, such as reducing production costs, optimizing labor and asset utilization, and production automation. Hardware partnerships should factor in metrics such as ease of deployment of sensors, power consumption of sensors (since most sensors operate on batteries and replacing them adds to the maintenance costs of sensors), technology differentiation, and price of the sensor systems. With sensors generating vast amounts of data, users have to also make critical decisions about what type of software platform to use, how to extract insight from the data, and ultimately how the sensor deployment will either drive revenue growth or reduce costs. Software partnerships should aim to pull together a variety of sensors so that there is a central interface. Data that can alert the technician or the end-user to an impending failure on a machine or drive better inventory control are important.

- More consolidation to come: Even as the sensor industry evolves, sensor developers — both big and small — should be prepared for massive consolidation. While developing a unique, high resolution sensor at low cost sounds attractive, when it comes to the sensors game, the sum of the parts becomes much more important than the performance of the individual components. Developers that can address multiple parts of the sensor module will survive.

About the Author

Pallavi Madakasira leads the Sensors Intelligence team at Lux Research , advising clients on market strategy & due diligence in emerging power electronics and LEDs. She received her received her M.S. in Physics from the University of Texas, Dallas, and her M.Sc (Hons.) in Physics from the Birla Institute of Technology and Science, Pilani, India.